Did you know?

The term 'Equity' means the amount you own in your home after a mortgage(s) is paid.

Equity Release with FREE Legal Work

Equity Release with FREE Legal Work

Many people sensibly consider downsizing to raise money rather than equity release. However, this is not always practical. Equity release lifetime mortgages are increasingly popular as you retain complete ownership of your property and the interest rate can be fixed for life.

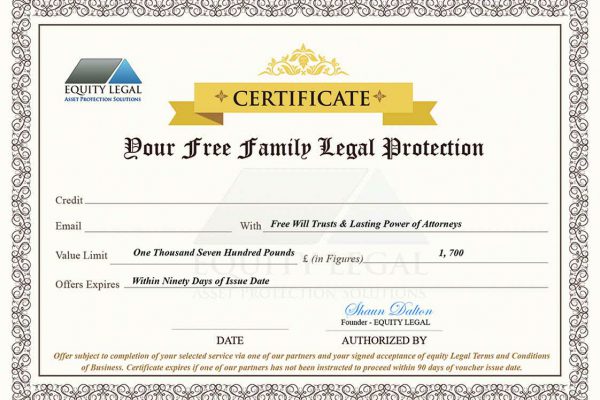

Risk averse people that take a lifetime mortgage can pay extra to guarantee they always retain a percentage of equity in their home, irrespective of accumulated interest. Equity release providers offering lifetime mortgages that are members of the Equity Release Council, abide by a code of customer protection known as S.H.I.P. (Safe Home Income Plans). This includes a provision that your loan plus rolled up interest cannot exceed the value of your property and you will never lose your home. Equity Legal are appointed introducers to Key Retirement Solutions frequently featured on TV and by far the UK’s largest independent equity release specialists. However, to qualify for your substantial free legal work it is essential that you instruct Equity Legal to introduce you to Key Retirement rather than registering your details directly. It is emphasised that you still retain the same terms had you enquired directly, but also qualify for up to £1,700 FREE Family Legal Protection that includes both types of Lasting Power of attorneys for Property & Finances and Health & Welfare together with a special Will trust. In fact, the Financial LPA is conditional for many Equity Release ‘Draw Down’ Plans.

Equity Legal does not offer equity release advice. We act as introducers to authorised and regulated independent equity release advisers. For more information about lifetime mortgages and home reversion plans and to understand the full risk implications, you should seek independent advice from an authorised equity release specialist. We act solely as information providers and allow visitors private access to financial calculators that graphically illustrate the risks of living longer and accumulated loan interest related to future estimated property values. However, you should always obtain a personal illustration in line with FCA (Financial Conduct Authority) and ERC (Equity Release Council) rules